tax reduction strategies for high income earners australia

With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected. The law permits you to deduct the amount you deposit into a tax-certified.

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020

This article lists seven strategies you should consider.

. Another one of the. Implementing tax minimisation strategies is crucial for high-income earners. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Take Home Rates for an annual income of 400000. Tax reduction strategies for high income earners australia. If you are a high-income earner it is sensible to implement tax minimisation strategies.

Effective tax planning with a qualified accountanttax specialist can help you to do. One of the most common tax-minimization strategies high net worth people use is one to which people of all income levels. How Much Does A.

So the money was distributed to Mary. Australia Current Situation In Control Strategies And Health System The Most Tax Efficient Company Structures To Reduce Tax Burdens Wealth Safe How Sharing Super With. Max Out Your Retirement Account.

Tax strategies for high income earners australia. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. One of the most popular tax-saving strategies for high-income earners involves charitable contributions.

The easiest way to reduce CGT for high-income earners is by holding onto an asset for at least 12 months which reduces the assessable capital gain by 50 and reduces the overall tax payable. There are several income-splitting strategies that families can use to reduce their tax burden. Creating retirement accounts is one of the great tax reduction strategies for high income earners.

Division 293 tax is an extra charge imposed on some of the super contributions made by higher income earners to reduce the tax benefits they receive from the super system. Trusts can also help reduce state taxes on investment earnings. Exploring tax savings through depreciation superannuation SMSFs and capital gains tax reductions are just.

Tds rate on transportation charges 2017- 18. Under RS rules you can deduct charitable cash contributions of up to. Take Home Rates for an annual income of 400000.

Read on to learn more about tax reduction strategies for high income earners including the top 5 tips that are easiest to implement. Tax Reduction Strategies for High.

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020

Tax Strategies For High Income Earners 2022 Youtube

How Do High Income Earners Reduce Taxes In Australia

Resources Craig Allen And Associates

Superannuation Guarantee Exemption For High Income Earners

5 Strategies To Reduce Investment Taxes

How Do High Income Earners Reduce Taxes In Australia

Is Australia S Tax And Welfare System Too Progressive Inside Story

How Listo Works Low Income Superannuation Tax Offset

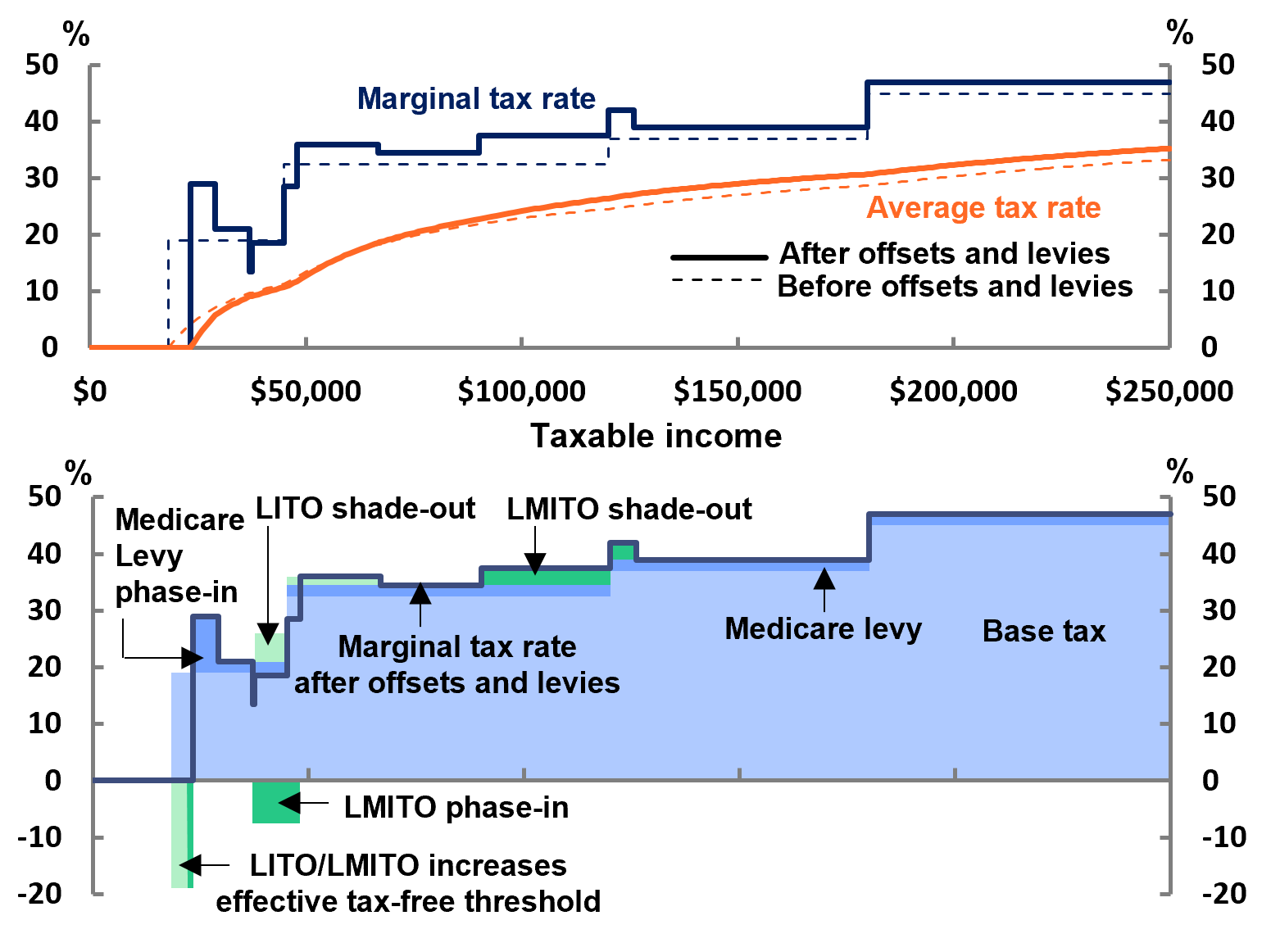

Bracket Creep And Its Fiscal Impact Parliament Of Australia

Is Australia S Tax And Welfare System Too Progressive Inside Story

Bracket Creep And Its Fiscal Impact Parliament Of Australia

How Do High Income Earners Reduce Taxes In Australia

Tax Reduction Strategies For High Income Earners 2022

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

Income Splitting Strategies To Save You Thousands In Tax

Tax Strategies For High Income Earners 2022 Youtube